If you’re considering investing in the booming Dubai real estate market, you might have come across the terms Freehold vs Free Zone in Dubai, UAE. Knowing the difference between these two investment options is essential for making the right decision for your particular situation. Freehold properties give you full ownership rights, while free zone companies have their own set of regulations.

Whether you’re looking to invest in a freehold property or a free zone company, understanding the difference will help you make the right decision. Consider your long-term goals and research the different regulations associated with each property type before making a final decision.

Freehold vs Free Zone in Dubai

Here’s a quick guide to help you understand the difference between Freehold vs Free Zone in Dubai, UAE property investments.

Freehold Properties

In Dubai, freeholds are properties in areas specially designated by the Ruler, allowing non-GCC nationals to own them. Under Law No 7 of 2006 Concerning the Land Registration in the Emirate of Dubai, Article 4 grants non-UAE nationals the right to purchase real estate in certain areas of Dubai and register their ownership with the Dubai Land Department. These properties are termed freeholds, granting them a secure ownership status.

In 2002, His Highness Sheikh Mohammed Bin Rashid Al Maktoum, the Vice President and Prime Minister of the United Arab Emirates and Ruler of Dubai, passed a decree that changed the country’s landscape. This decree allowed non-GCC nationals to purchase property in the freehold areas of Dubai, granting them the right to own the land and the housing unit and the freedom to sell, lease, or live on the property.

This ground-breaking decree opened the door for people worldwide to invest in the luxurious real estate of Dubai. When a property is purchased in any of the freehold areas of Dubai, the buyer’s name is registered with the Dubai Land Department, making them the legal ‘landowner’ and granting them a title deed.

The freehold contract is in place for an indefinite period of time, and upon the owner’s death, an heir can inherit the property. This allows the same property to remain in the same family for generations. This decree has blessed those who have taken full advantage of it. It has allowed people to own properties in some of the most luxurious locations in the world and has enabled them to pass on the legacy of these properties to their children and grandchildren.

-

What Does Freehold Essentially Mean?

Freehold properties in Dubai are the perfect choice for those looking to make a long-term investment. With a range of contemporary living spaces, world-class amenities, and unbeatable views, these properties offer a luxurious lifestyle in the city’s heart. From sky-high apartments to sprawling villas, there’s something to suit every taste and budget. With the assurance of ownership and a great return on investment, freehold properties in Dubai are the ultimate investment.

-

Freehold Areas in Dubai

Dubai is home to 23 freehold residential areas, with some of the most popular being:

-

- The Palm Jumeirah

- Emirates Hills

- The Meadows

- The Lakes

- The Springs

- Dubai Marina

- Jumeirah Lake Towers

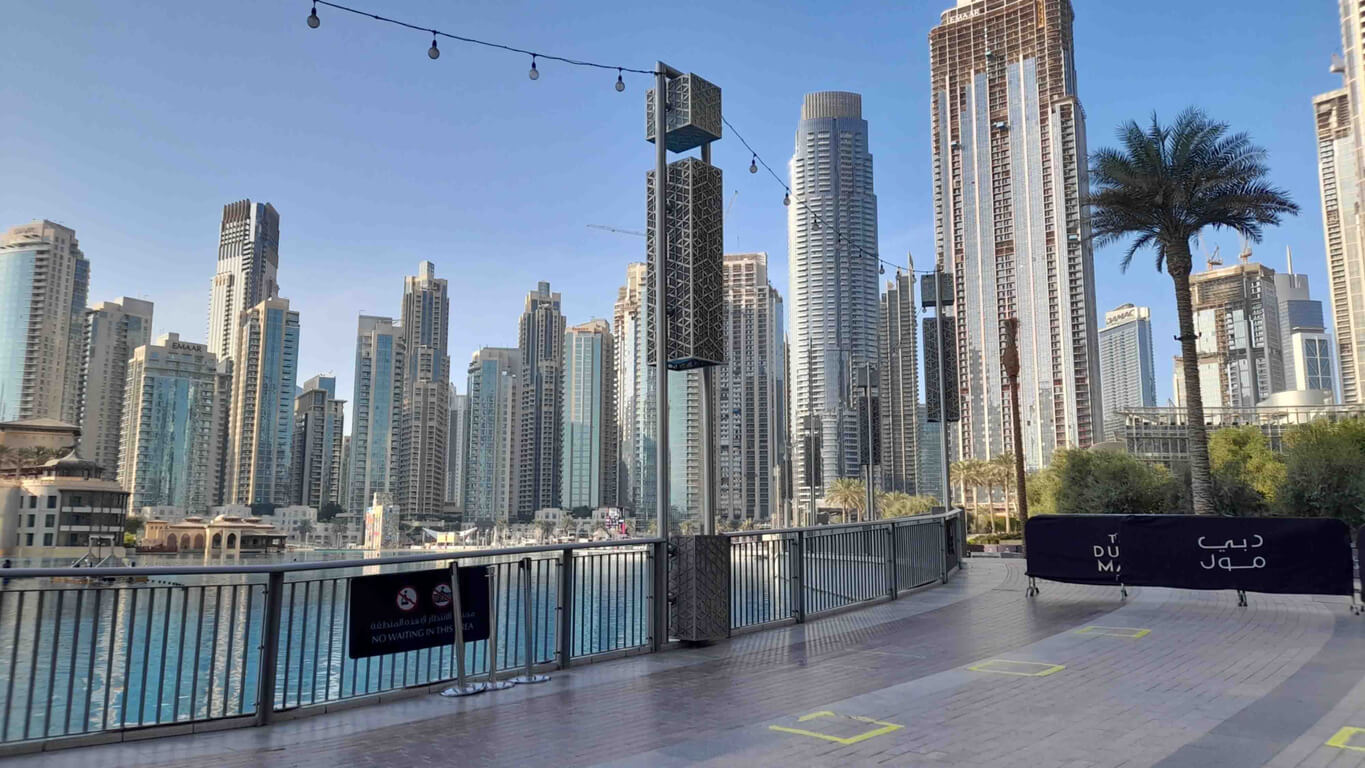

- Downtown & Old Town Burj Khalifa

- Discovery Gardens

- Dubai Investments Park

- Jumeirah Beach Residence

- The Greens

- Arabian Ranches

- Falcon City

- The Villa

- Al Barari

- Dubai Sports City

- Motor City

- Green Community

- Business Bay

- International City

- IMPZ

- Jumeirah Village

- Jumeirah Islands

-

Who is Freehold Properties Best for?

Freehold properties are best for people looking to own a property outright, looking for long-term security and stability, and having the financial resources to cover the costs associated with purchasing and owning a property. Freehold properties are also ideal for people looking to build equity and take advantage of the potential appreciation in the value of their homes.

-

Parameters to Bear in Mind Before Investing in Freehold Properties

Freehold property offers a range of advantages to potential buyers, including:

-

- Ownership of the property, with the ability to rent, lease or sell as desired.

- Full control over the property, with no landlord or other external restrictions.

- Vast investment opportunities, as the property can be passed down through generations.

- Business-friendly for foreign investors, with the option to own up to 49% of the company shares and no need for a local partner.

However, it is important to think about the potential drawbacks of freehold ownership, including:

-

- High costs associated with buying a freehold property, including stamp duty and legal fees.

- The potential for disputes between owners and tenants, particularly if the tenant has not kept up with payments.

- A lack of protection from external factors, such as market changes or local regulations.

- The property needs regular maintenance and upkeep to ensure its value does not depreciate.

Free Zone

Dubai offers business owners and foreign companies a unique opportunity to grow with its exclusive free trade zones. These areas provide tax exemptions that make investing in Dubai ideal for businesses that use the region as a manufacturing or distribution hub. Furthermore, business owners are granted full ownership when establishing them in the free zone UAE, giving them complete control over their investments. With its strategic geographical location and attractive tax incentives, Dubai is the perfect place to grow and develop a prosperous business.

The Dubai Free Zone (DFZ) was established in 1985 as the first free trade zone in the Middle East. It was created to attract foreign investment and facilitate international trade. The DFZ is divided into two main areas: the Jebel Ali Free Zone (JAFZA) and the Dubai Airport Free Zone (DAFZA).

JAFZA is the largest free zone area in the UAE and covers an area of 48 square kilometres. It is home to over 7,000 companies from over 100 countries, with a combined annual trade value of over US$90 billion. The zone offers businesses a range of benefits, such as 100% foreign ownership, no corporate or individual taxes, and a wide range of business activities.

DAFZA is the second-largest free zone area in Dubai and covers an area of 17.3 square kilometres. It is home to over 1,600 companies from over 70 countries, with a combined annual trade value of over US$36 billion. The zone offers businesses a range of benefits, such as 100% foreign ownership, no corporate or individual taxes, and a wide range of business activities.

The continued success of the Dubai Free Zone has made it a model for other countries in the region to replicate. The free zone’s success has also helped drive foreign investment and economic growth in the UAE, making it one of the most prosperous countries in the Middle East.

-

What Does Free Zone Essentially Mean?

The Dubai Free Zone is an area within the city of Dubai designated as a free trade zone. This means businesses in the area are exempt from corporate taxes and can benefit from other incentives, such as simplified business procedures and streamlined regulations. The Dubai Free Zone has become a hub for global commerce and trade, attracting businesses from all over the world and helping to drive Dubai’s economy. It is one of the main reasons Dubai has become a global financial hub. It is a great place for entrepreneurs and businesses to take advantage of the business-friendly environment. The Free Zone UAE is also home to a number of government offices, and it is becoming increasingly popular among those looking to invest in Dubai.

-

Free Zone Areas in Dubai!

Dubai is home to some of the world’s most dynamic free trade zones, offering businesses many opportunities for growth and success. There are currently 24 free zones operating in Dubai, and some of them have been mentioned below:

-

- Dubai Airport Free Zone

- Dubai Cars and Automotive Zone (DUCAMZ)

- Dubai Healthcare City

- Dubai International Academic City

- Dubai Internet City

- Dubai International Financial Centre

- Dubai Knowledge Village

- Dubai Media City

- Dubai Gold and Diamond Park

- Dubai Multi Commodities Centre (DMCC)

- Dubai Silicon Oasis (DSO)

- International Media Production Zone

- Jebel Ali Free Zone

- Dubai World Central (DWC)

-

Who is Free Zone Properties Best for?

The Dubai Free Zones are best for businesses looking for 100% foreign ownership, zero taxes, and an efficient business set-up process. These areas are ideal for international businesses looking to establish a presence in Dubai and local businesses looking to benefit from Dubai’s business-friendly environment and infrastructure. Free Zones offer different advantages and benefits, so it is important to research which is best for your business.

-

Parameters to Bear in Mind Before Investing in Free Zone Properties

Free zone areas offer a range of advantages to potential investors, including:

-

- Full ownership of the company without the need for a local partner.

- Freedom to operate with special considerations and fewer restrictions.

- Elimination of taxes in some areas.

- Opportunity to conduct multiple business activities.

However, it is important to consider the potential drawbacks of free zone areas, including:

-

- Operations are limited to the Free Zone area in the Emirate, preventing companies from expanding beyond.

Freehold vs Free Zone in Dubai : Which One Should You Invest In?

Investing in Dubai offers a variety of options, depending on one’s purpose. In a freehold area, foreign investors must find a UAE national partner to hold a maximum of 51% of the company’s shares, while they control the remaining 49%. However, with the announcement of the new company laws, foreign investors can now own 100% of the company outside of the free zones in the UAE.

For those seeking to own property in Dubai, freehold areas are the ideal option. Off-plan investments can be particularly lucrative, as prices are generally lower and the potential return on investment is far greater. On the other hand, Dubai’s free zones are great for those looking for 100% ownership, although these businesses are limited to the free zones and cannot expand beyond this. ultimately, the choice between Freehold vs Free Zone in Dubai depends on what one wants to invest in, and the amount of control one wishes to have as a business owner.

Key Takeaways

Both, freehold and free zone areas in Dubai offer a wide array of benefits for people looking to set up a business in the province. Freehold areas provide a greater degree of control and ownership for businesses, while free zones offer tax-free trading and simplified procedures for setting up and running a business. Both areas have their own advantages and disadvantages, and businesses should research thoroughly before deciding which area is best for them.

Some More Useful Articles for You :

|

Explore Motor City Dubai |

|

|

Pros and Cons of Living in Studio Apartment |

|

|

Pros and Cons of Living in Dubai South |

|

|

Pros & Cons of Living in Dubai Silicon Oasis |

|

|

Pros & Cons of Living in Dubai Marina |

Frequently Asked Question (FAQs)

Freehold in UAE means the right to own a property in perpetuity, with no limits on the time it can be held.

Freezone is a special economic zone within the UAE where companies have more freedom and autonomy than in Mainland UAE, with lower taxes and fewer regulations. Mainland UAE is a traditional area governed by the government.

In Dubai, companies registered in Free Zones can own property in areas designated for this purpose.

Freezone offers tax incentives, 100% foreign ownership, and access to global markets.

Freehold ownership grants individual ownership of a property in the UAE in perpetuity. What does freehold mean in UAE?

What is Freezone vs Mainland UAE?

Can a Freezone company own property in Dubai?

What are the benefits of Freezone?

What is freehold ownership in UAE?