With its iconic buildings, luxury properties, and dynamic lifestyle options, Dubai’s property market has seen both successes and failures. Learning the merits and demerits of factors that drive the value of real estate in Dubai is essential for shareholders, clients, and sellers to make wise choices in this competitive marketplace. Moreover, Before considering any investment choices, it is possible to speak to regional real estate specialists, undertake complete due investigations, and remain current regarding economic and market situations. Let’s understand the factors affecting property investment in Dubai.

Factors That Impact Your Property Investment in Dubai

Property type is an important component influencing investment results in the Dubai real estate market. This is because numerous properties appeal to different demographic segments, have varied maintenance requirements, and are subject to distinct market trends. Some of the factors affecting property investment in Dubai include:

-

Location

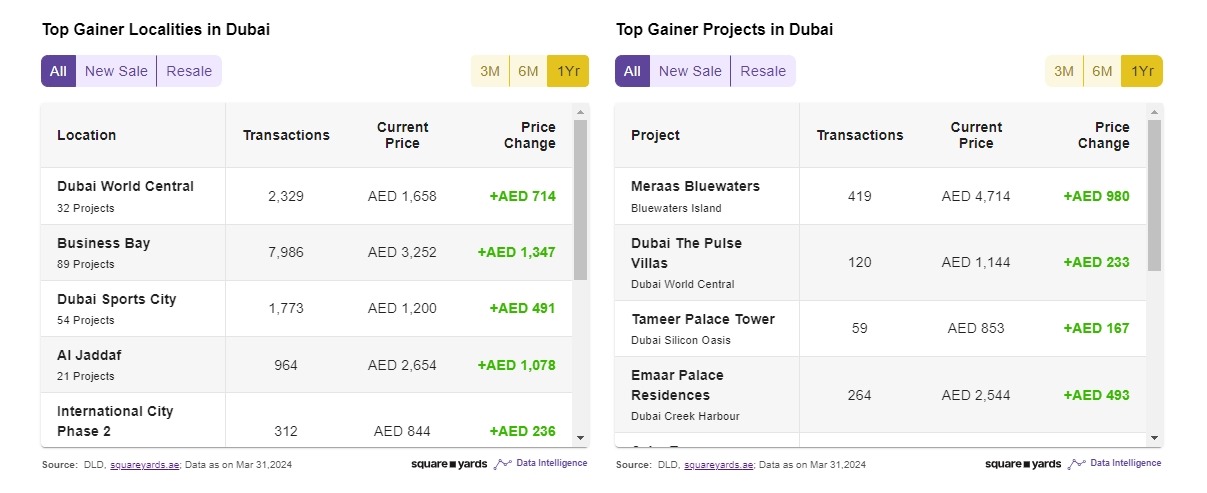

Location is one of the most significant factors in Dubai property investment, especially when you are planning to reside in a diversified and strategically built metropolis. The importance of location affects each aspect of real estate investing, from prospective revenues to the type of renters who are attracted to the building. Investing in a suitable location can also be a risk mitigation strategy against volatile markets. Prominent areas are less impacted by financial crises than peripheral or less established places, making them safer investments during difficult times.

Moreover, a welcoming atmosphere and closeness to vital facilities determine housing costs. Properties in desirable regions, such as near the coastline or the city centre, will be more expensive than those in less popular areas. Such locations are in high demand among purchasers due to neighbouring attractions, recreational opportunities, and transportation interchanges.

How to Get the Insight?

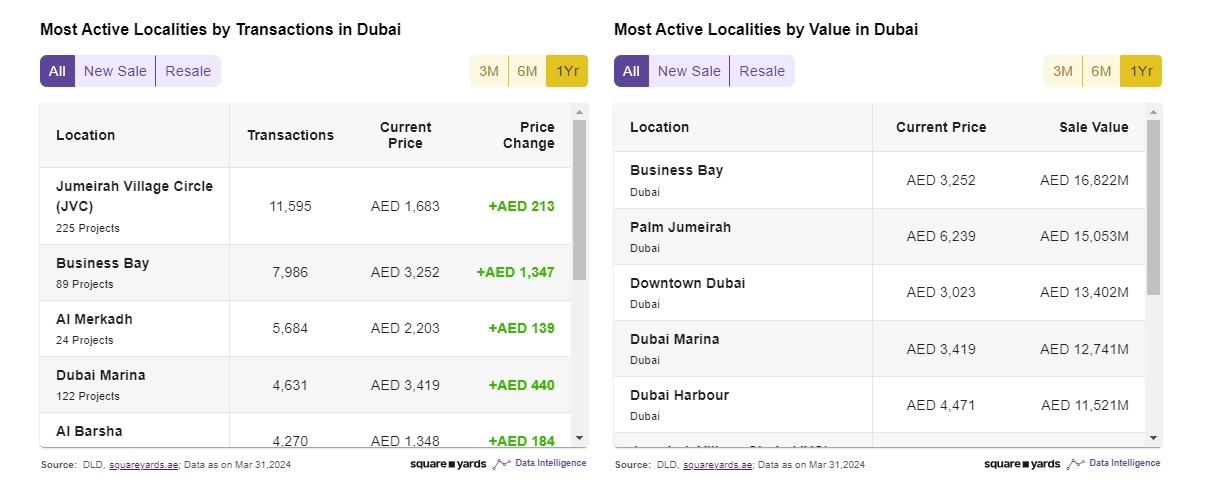

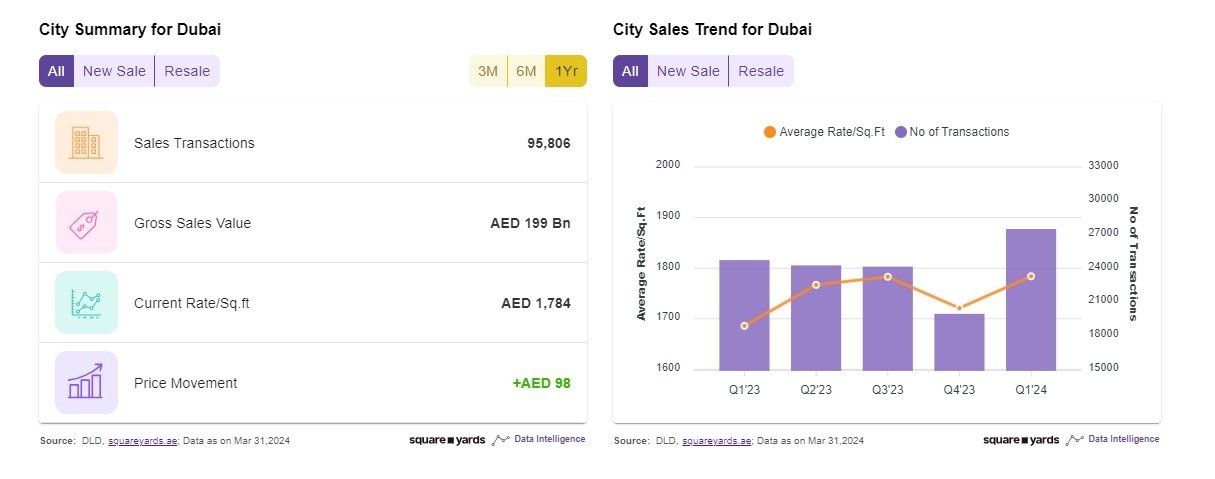

You may narrow your options and explore other places using the data below on square yards.

-

Property Type

Undoubtedly, property type and size are among the most important factors affecting property investment in Dubai. It is always a good idea to consider and plan. Distinct property types meet specific demographic categories. For instance, residential properties such as apartments and villas attract families and immigrants residing in Dubai. In contrast, commercial properties such as office spaces or retail outlets provide businesses and entrepreneurs. Selecting a property type that matches a specific field’s demographic desires and requirements assures a steady request, improving rental yields and the possibility for capital growth.

However, each property kind carries its own risk assessment. Residential properties usually have less risk than commercial properties, which can influence global economic circumstances. Identifying these risks is critical for creating a balanced property portfolio corresponding to an investor’s risk aversion and investing timeframe.

-

Historical Transactions

Historical transaction data enables investors to examine how real estate prices have changed over time in various locations in Dubai. Investors might identify trends like price increases or decreases in specific regions by analysing previous selling and renting transactions. This data is critical for determining the present market value of assets and forecasting future trends. Moreover, historical transaction data show how the market has been continuously strong, assisting investors in identifying areas of ongoing interest. Demand for properties frequently connects with higher liquidity in the real estate market, making transactions with properties simpler and quicker when purchasing or selling.

Further, analysing historical transactions for Dubai property sales allows you to determine the market’s triumphs and lowest points in previous cycles. This knowledge is essential for risk assessment, allowing buyers to prepare for future downturns and manage risks via selective rotation or other methods.

How to Get the Insight?

Researching previous transactions is critical in estate investment, especially in an ever-changing market like Dubai. This data offers investors important information that may affect their decisions in several major ways.

-

Interest Rates and Return on Investment(ROI)

Interest rates can significantly affect the real estate market. Low-interest rates make it simpler for entrepreneurs to secure financing when investing in property. In contrast, high-interest rates may make it challenging for buyers to get financing, lowering interest in the property. The real estate market in Dubai is renowned for being tax-free, making it a popular choice for overseas purchasers. The absence of real estate taxes also allows owners to generate more revenues. This has raised demand for property in Dubai, notably from international investors. Moreover,

calculating the return on investment (ROI) is important in appraising any real estate project. ROI is a profitability metric that shows how much profit or loss may be predicted with the beginning investment. In addition, return on investment (ROI) in Dubai property can be influenced by factors such as Rental income, Capital appreciation, and Property management fees.

How to Get the Insight?

In Dubai, where the estate market is expansive and intricate, selecting the appropriate property type is crucial for integrating investment approaches with marketplace conditions, monetary objectives, and risk mitigation. Let’s delve deeper to understand better.

-

Number of New and Renewed Contracts

The number of new and renewed rental contracts is an important indicator for real estate investors in Dubai, showing the well-being and trends in the property sector. The amount of new contracts executed reflects the current interest in properties in different areas of the Dubai property market. A substantial amount of new leases or acquisitions shows strong consumer demand and a robust financial landscape. In contrast, a boost in renewed rental contracts may suggest customer satisfaction and stability, as previous tenants or enterprises prefer to reside in their present locations, reflecting asset owners’ payment flow dependability.

The number of new and renewed rental contracts is an important measure for property owners in Dubai because it reflects the health and dynamism of the property market. This data gives significant insights into numerous essential areas of real estate investment:

-

Market Trend

Understanding the present market position allows investors to determine if the market is growing, stable, or declining. This insight can substantially impact investing decisions, notably timeframe and price. For instance, buying property in Dubai throughout expansion might require higher initial expenditures but result in higher long-term capital appreciation. On the other hand, purchasing during an economic crisis may allow for lesser entry costs but also increases the danger of declining or dropping property value.

The Dubai property market is strongly influenced by both demand and supply variables. The city’s swift growth and expansion have increased demand for homes, placing a premium on costs. The growing number of new homes has been unable to accommodate requests, resulting in rising costs. According to the Dubai Land Department (DLD), Dubai’s overall supply of residential units was 561,000 at the close of 2023. This marks a 6.6% increase over the previous year. However, demand for property has increased faster than supply, resulting in an abundance in some areas of the city.

-

Builder Reputation

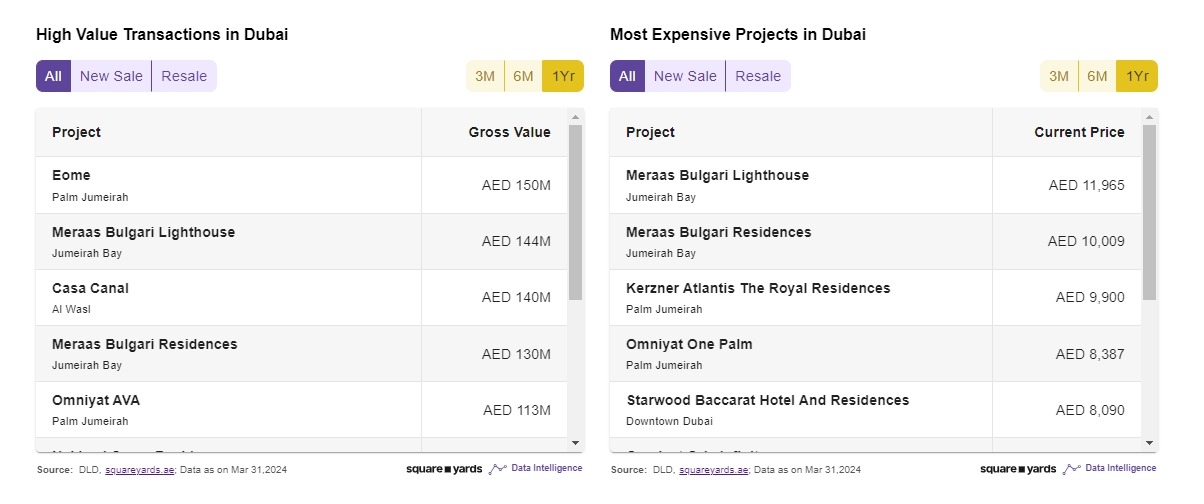

Knowing the developer and their market reputation is one of the most important factors affecting property investment in Dubai, particularly if you’re purchasing an off-plan property investment in Dubai. Reputable developers are regarded for upholding rigorous building craftsmanship and creative design standards. Buying in buildings created by reputable and dependable developers may significantly mitigate the risks of poor building quality, which can impact the property’s durability and selling price.

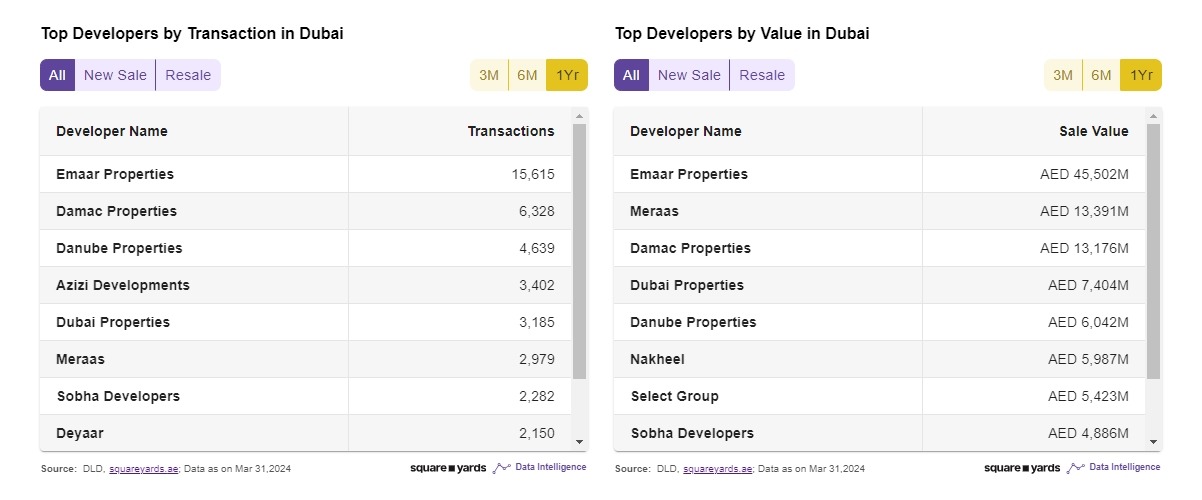

Moreover, several major developers have established their presence in Dubai, considerably impacting the real estate market. Emaar, Nakheel, and Meraas are among the leading developers. These builders have an impressive residential, business, and retail property portfolio. They have enormously influenced Dubai’s property market by developing several of its finest buildings.

How to Get the Insight?

A developer’s reputation in Dubai’s competitive real estate marketplace is vital to achieving investment success.

-

Services and Amenities

Choosing suitable services and amenities for your property can significantly improve your living experience. However, with so many options available, it can be difficult to determine what is truly vital. Here are some things to consider:

- Lifestyle: When selecting facilities, it is crucial to think about your lifestyle. If you are a sports enthusiast, consider a property with a fitness centre, pool, or walking routes. If you work from home, consider an apartment with a co-working space. If you have pets, consider an apartment with a pet-friendly policy and amenities like a dog park.

- Convenience: Many convenience features can help you live more comfortably. These amenities include in-unit laundry, dishwashers, and trash disposal. Select an apartment that includes a parking garage or valet parking.

- Community: Choosing a property with features that promote a sense of belonging can enhance your living experiences.

- Budget: Choose facilities within your budget. Consider the expense of these services, such as some amenities, the type of property, and its conditions.

How to Get the Insight?

The Square Yards community insights tool, powered by Data intelligence, can tell you everything you need to know about the community that interests you. It provides a more in-depth look at the area’s facilities and services, including lifestyle, Neighbourhood and Residents’ ratings, average rental and selling costs, etc.

Conclusion

To summarise, various factors influence the potential for growth of real estate investments in Dubai, and buyers should be aware of them before entering this industry. Addressing these aspects can help you make more educated and profitable assessments. Moreover, the factors discussed above immediately affect demand and real estate values. To learn more about the elements that influence the market value and buying property in Dubai, you can speak with square yards specialists from real estate organisations.

Disclaimer *

The aforementioned factors affecting property investment in Dubai are subject to the market. To learn more about the Dubai property investment, you can easily contact Square Yards with one click or call to clear your doubts.

Similar Suggestions For You:

|

Invest in a Property in Dubai |

|

|

Successful Real Estate Investment in Dubai |

|

|

Applying For A Gold Loan in the UAE |

|

|

Real Estate Investment Strategy |

Frequently Asked Question(FAQ’s)

Besides freehold ownership, Dubai has a tax-friendly atmosphere framework that allows you to avoid property taxation, capital gains tax, and income taxes on leasing profits, which is an important benefit for property buyers in Dubai.

Investment in an established community or a new development varies from person to person. However, several factors, such as budget, location, locality, property type, and property conditions, can be considered.

Dubai's shoreline provides a breathtaking setting for beachside residences. Shareholders can choose from luxury villas, penthouses, and apartments near the shore. These real estate investments offer an incredible view and generate significant rental revenue due to the high demand for coastal living.

Purchasing off-plan properties in Dubai can be a profitable investment decision. Off-plan property refers to those currently under development or not yet completed. Buyers can purchase a property for less than it might cost once the construction is done, potentially leading to immense capital gains.

Choosing the appropriate size and style of real estate for your investment may significantly affect your results. Spacious apartments are popular in Dubai since they provide greater space and utility, enticing families and individuals with a little extra money to spend.

The government contributes significantly to market integrity and investor trust by controlling borrowing limits and ensuring transparency in real estate transactions. What are the main benefits of investing in property in Dubai?

Should I invest in an established community or a new development?

What types of properties are best for investment in Dubai?

Should I consider off-plan property for investment in Dubai?

Is investing in a spacious property or a smaller unit in Dubai better?

How do government regulations and policies impact property investment in Dubai?