Dubai epitomizes aesthetic skyscrapers, apartments, complexes, and whatnot. It is an ideal place to buy luxurious property or land where you can conveniently build and design your home. With the involvement of new and developing properties, investors worldwide are in the queue to invest in a property or land. If you want to build your dream home from scratch and want interiors that complement your style, applying for housing land is the right option.

This blog aims to answer all your questions and doubts about applying for housing land in Dubai!

What is Housing Land?

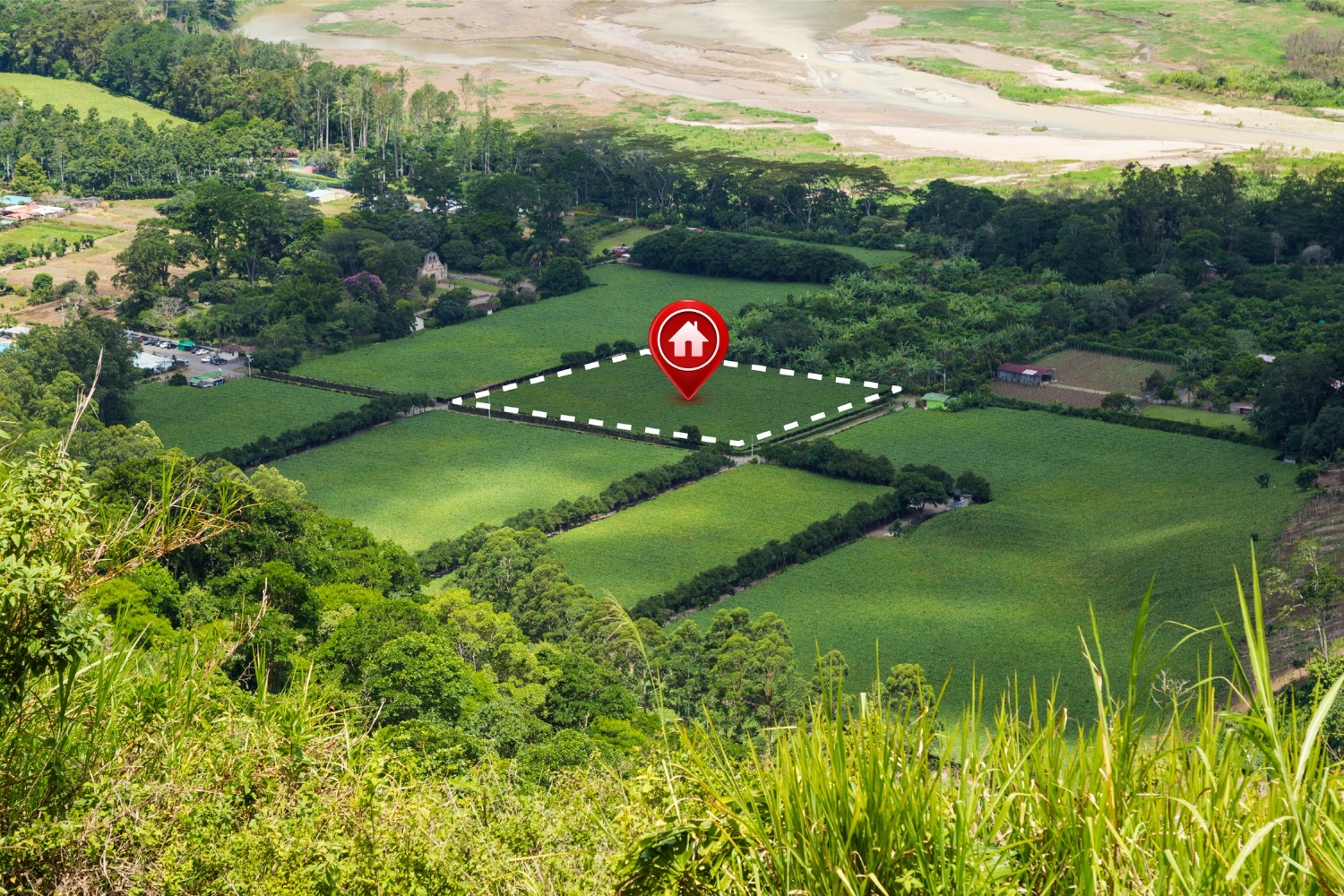

Housing lands refer to plots or barren lands owned and occupied for residential development. Individuals purchasing housing land can use the land to construct a villa, townhouse, or apartment. The land can be sold or purchased as freehold land where the buyer enjoys full ownership without any restrictions, whereas leasehold lands provide ownership for a long term (up to 99 years). Dubai’s urban landscape and infrastructure are governed by strict rules and regulations the authorities impose.

Types of Housing Land in Dubai

Dubai consists of several types of housing plans, including:

- Apartments

- Townhouses

- Villa

- Duplexes

- Affordable Housing plans

- Studio Apartment

- Penthouses

- Lofts

- Warehouses

However, besides the residential plans, you can opt for land for other purposes, such as commercial, office, or mixed-use. There are also types of ownership associated with purchasing housing land.

- Freehold Plot: People from the UAE or ex-pats can purchase land, enjoy full ownership rights, and utilise it according to their will.

- Leasehold Plot: This type of ownership is only limited to UAE nationals. The purchasers don’t have full ownership; however, they have the plot claims for a long duration of time ( up to 99 years)

- Industrial Plot: These plots are designated only for warehousing, manufacturing, and other industrial purposes.

Benefits of Applying for a Housing Land in Dubai

Dubai has several residential properties and buildings you can invest in or buy. However, if you are considering creating your own space, choose a housing area with a convenient open floor that can meet all your requirements and needs. Buying land is a far better option as it is permanently present, and you can design and plan your home according to your preferences and style. You can choose materials, wallpapers, flooring, and furniture that suit you and complement your personality.

Housing land is far more beneficial because of its long-term benefits. With the rise in property value, you are investing in something that has a promising future. Invest in a land strategically and choose the best location and other essential amenities like a hospital, school, or workplace. After investing in housing land in Dubai, build a luxurious home that becomes the epitome of beautiful infrastructure.

If you want a steady income stream, you can purchase land and list it for rental purposes. Choose a location with a high demand for property rentals. This will benefit you in the long run as people seek opportunities to rent a well-planned property that provides a luxurious feel. Lastly, you will gain ownership and control over your property, allowing you to transform, make changes, and invest according to your preferences.

Eligibility for Purchasing a Housing Land

It is essential to check and understand the eligibility criteria before buying housing land in Dubai. The UAE has a dynamic and constantly changing set of rules and regulations. You must be aware of these eligibility criteria when purchasing land.

-

- Age: People should be 21 or older to purchase land in Dubai.

- Freehold areas: Expats who are not UAE nationals can purchase land only in certain designated areas and enjoy full ownership rights.

-

- Residency: Obtaining a UAE residence visa may make the process simpler and faster. However, it is not a mandatory requirement.

- Financial Capacity: Availability of funds and proof of finances are integral when purchasing land.

- Legal Eligibility: Before the background check, a person planning to purchase land must have a clean credit and loan history and ensure compliance with Dubai’s property laws and regulations.

UAE nationals and expats must follow the criteria required to purchase housing land. This includes signing necessary documents and registering the land under the Dubai Land Department. Before purchasing housing land, you must co nsult a real estate agent or an expert about the eligibility criteria and other requirements.

Ways to Finance Your Housing Land Purchase In Dubai

It is an essential and crucial step when purchasing land in a city like Dubai. Before finalising a land purchase, ensure your finances are settled and confirmed. However, if you still don’t know how you will finance your residential property, here are a few ways you may opt.

- Self-Financing: Many people, when they decide to purchase land or invest in something that has great purchase value, often self-finance it. These people or financers don’t hold any obligation to repay loans and enjoy full ownership without the hassle of large amounts of paperwork. This gives them the benefit of being flexible and building a home in a steady way that is constructed according to their timeline and preference.

- Personal Loan: You can also opt for a personal loan from a bank. A personal loan is beneficial as you only have to revert to the bank, according to your convenience. Still, they have a comparatively high interest rate that comes along with the loans. They are a popular option for purchasing housing land because of their accessibility. However, every bank has a different policy regarding the terms and conditions. Banks in the UAE provide mortgage loans and cover the whole charge from purchasing to construction if planning to do so. On the other hand, some developers offer terms where they are the financers and provide favorable conditions for the purchaser.

- Government Grants: If you plan to purchase housing land, look up all the benefits and subsidies the government plans to provide during that particular time. This may benefit you and will assist you in purchasing your dream housing land.

- Off-Plan Financing: This type of financing is monetarily favorable for land buyers as it provides an installment-paying option for the project’s development. It allows the buyer to explore a project that could have future benefits.

Steps To Send an Application for a Housing Loan

Above, we have explained in detail the benefits of purchasing housing land. However, one must follow a procedure before buying housing land. Here are the important steps you need to adopt before your purchase.

- Check your Eligibility: Purchasing a housing lot may not seem taboo; however, you must check your alignment with the eligibility criteria before applying for it. The criteria include age, income, work status, loan, and credit history.

- Create a Buyer and Seller Contract: If you have already set up your eye on a property you adore and wish to finalise, create a contract with all the essential terms and conditions you wish to avail yourself of while purchasing. You may also negotiate accordingly. To avoid future problems, discuss all the necessary terms and conditions about the payment procedure directly with the seller. Also, avoid any kind of hassle before purchasing. However, you must ensure that the purchasing procedure occurs within the legal framework.

- Sign the MOU: A Memorandum of Understanding (MOU), commonly referred to as a sale contract (Form F), can be downloaded from the Dubai Land Department (DLD) website. You can add your own along with the default terms listed on the form. For extra security, have both parties sign the agreement before a witness at the Registration Trustee’s office. Additionally, until the transaction is finished, the Registration Trustee will retain a 10% deposit on the property.

- Apply for NOC: Before declaring ownership, you must get an NOC from the developer selling you the plot. This is a type of confirmation that clarifies that you have no bills that are outstanding or you are still left to pay some amount. After the clearance of the NOC, you may go ahead with the rest of the procedures included during the land purchase.

- Visit the DLD Office: This is the last step you need to take before finalising the ownership. The buyer and the seller must visit the DLD (Dubai Land Department) office for a documentation procedure. The documents you need to carry before heading to the office are the cheque that you will give the seller, identification proof of both the buyer and the seller, the NOC issued by the developer, and signed Form F. After completing this task, the DLD will hand you the ownership, and you will become the property owner. Documentation is essential for legalising your ownership.

Furthermore, you have to pay for a few more requirements during the transfer of ownership.

- The floor plan

- Issuance certificate of title deed

- Plot map for land outside Dubai Municipality jurisdiction

- Plot map for a combined map with Dubai Municipality

- Knowledge fee

- Innovation fee

Conclusion

Applying for housing land in Dubai is not a complicated process. Knowing the eligibility requirements, finance, laws, and regulations, you can easily purchase housing land for UAE nationals and expats. It is crucial to conduct proper research about the type of plot and the locality to avoid future disruptions. Settle your documentation and get your plot registered, strictly following the laws that the Dubai Land Department defines. Whether you purchase land for residential or investment purposes, it is always beneficial and opens the door to profitable investment opportunities in a city like Dubai.

This was all about applying for housing land in Dubai. However, if you still have doubts, here are some frequently asked questions that might help!

Similar Suggestions For You:

|

About Granted Property in Dubai |

|

|

Guide to Dubai Rental Properties |

|

|

Understanding Dubai Property Investment |

|

|

Usufruct tenancy contract in Dubai |

|

|

Explore Dubai Mortgages for Non-Resident |

|

|

Popular Branded Residences in Dubai |

Frequently Asked Questions(FAQ’s)

Choose areas like Dubai Hills Estate, Palm Jumeirah, Al Furjan and Jumeira Village Circle.

If you want to buy a property in Dubai, you must be aware of the market and the current rates of the properties. Research well before making a decision. Set a budget while hunting for a property. Meet real estate agents and finalise the property you wish to purchase. After that, the legalities and eligibility procedures will occur, followed by the source of your finances. Sign the agreement and finalise the ownership.

A freehold property refers to ownership that gives the buyer full control of the building and the land and the maximum freedom to use the purchased land according to the buyer's will. Leasehold properties refer to the right to occupy land or a building for a time(mostly 99 years) at a lower cost. It is different than owning land and having control over it.

The master developer of your property decides the timeframe for you to construct something on your land. Some developers prefer a specific time period for you to start construction. On the other hand, some developers don’t set any deadlines and are flexible. Being an expat, which location would be the best for buying housing land?

How can I buy a property in Dubai?

What is the difference between freehold and leasehold properties?

If I buy a freehold plot in Dubai, is there a specific timeframe during which the construction needs to be done?