The Wage Protection System is a UAE government initiative designed to ensure employees are paid on time. Though conceptually linked to UAE labour law, it can be challenging for many to comprehend. Nevertheless, employers and employees must know about the Wage Protection System UAE. This blog will cover all the details of WPS UAE.

About the Wage Protection System(WPS) UAE

The Wages Protection System UAE was introduced in July 2009 under Ministerial Decree No 788. It was an effort by the Ministry of Human Resources Emiratisation (MoHRE) in collaboration with the UAE Central Bank. The WPS safeguards workers’ pay in the UAE and ensures timely payments. Therefore, employers must upload employee salaries into the WPS database for verification by MoHRE and the Central Bank.

Such a system is required to prevent employers from taking unlawful actions, such as paying employees improper compensation, withholding payments, obtaining funds from unapproved sources, etc.

-

The Goal of the Wage Protection System UAE

The WPS safeguards workers’ wages, which is essential in the UAE due to its large labour force. It addresses unpaid salaries and delayed payments, reduces labour conflicts, and protects workers’ rights. Additionally, it helps employers automate payroll, saving time and avoiding disputes.

-

Working of Wage Protection System UAE

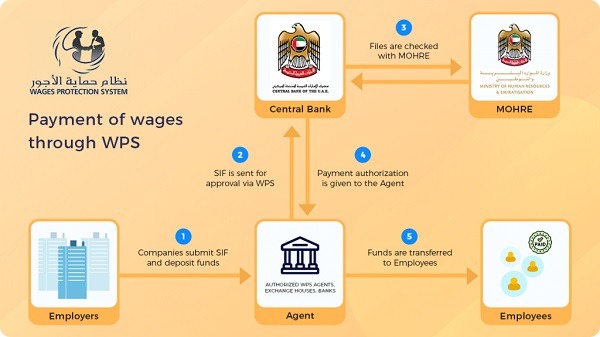

The Wages Protection System UAE uses a straightforward process involving employers and the government to ensure secure and timely employee salary payments. Here’s how it works:

-

-

Preparation and Submission of the Salary Information File (SIF):

-

Employers create a SIF with details such as the employee’s salary, benefits, and deductions. This file includes key data such as the employee’s labour card number, bank details, salary start and end dates, and other relevant information.

-

-

Validation by MoHRE and the Central Bank:

-

After submission, MoHRE and the Central Bank review the SIF for accuracy and compliance. They ensure that the employer adheres to the law as per the WPS regulations.

-

-

Issuance of Payment Order:

-

If the salary information is validated and error-free, MoHRE and Central Bank issue a payment order to the WPS agent to release the funds. If discrepancies are found, the employer must correct and resubmit the SIF.

-

-

Salary Transfer to Employee Accounts:

-

Once the payment order is issued, the WPS agent transfers the salaries directly into the employees’ bank accounts. Some employees may receive a WPS Payroll Card, which works like a debit card and enables easy withdrawal of funds.

Advantages of WPS UAE for Employers and Employees

The Wages Protection System UAE offers several benefits for employers and employees. These benefits include –

-

Advantages for Employers

- Wage Protection System UAE simplifies payroll management with a standardised system, ensuring accurate and timely salary payments. It also reduces administrative errors and legal issues.

- Complying with WPS provides businesses with legal proof of payment and helps to avoid disputes, fines, and penalties.

- Moreover, it improves the employer’s reputation, attracts better talent, and prevents penalties associated with non-compliance.

-

Advantages for Employees

- Employees receive their salaries directly in their bank accounts thanks to the WPS UAE. It also protects them from unfair practices like delayed payments or unauthorised deductions.

- The system promotes clarity in salary transactions.

- It helps minimise wage-related conflicts.

- The WPS UAE protects employees’ rights under UAE labour laws.

-

Banks

WPS UAE uses banks to secure wages and transfer them to employees. The institutions need a bank account for this purpose.

-

Financial Agents

Financial agents are similar to banks that legally provide payment services using WPS. The Central Bank UAE legalised these financial agents.

Essential Components of Wage Protection System UAE

The essential components of the Wages Protection System UAE include the following:

-

- Legal Framework: Established by MoHRE and applicable to all registered companies in the UAE.

- Salary Transfer Mechanism: Salaries are transferred through approved banks, financial institutions, and exchange houses. Payments are processed electronically, ensuring transparency and accountability.

- Compliance and Monitoring: Employers must register with WPS and submit employee salary data to MoHRE. It monitors salary payments to ensure compliance with labour laws.

- Enforcement and Penalties: Non-compliance can lead to fines, suspension of work permits, and a ban on future visa applications.

- Employee Rights and Protection: WPS guarantees timely payment of salaries and helps prevent disputes regarding unpaid wages.

-

Guidelines for Wage Protection System UAE

Wage Protection System UAE ensures that employees receive timely and accurate salaries. Employers must submit a SIF for each payroll cycle, which MoHRE and the Central Bank must validate. Employers must pay at least 75% of wages on time. According to the WPS salary system UAE, salaries must be disbursed within 15 days of the due date, with non-compliance resulting in penalties, fines, and business restrictions.

-

Function of the Ministry of Human Resources and Emiratisation (MoHRE)

The Ministry of Human Resources and Emiratisation is central to the Wages Protection System UAE. Its primary responsibilities include:

-

- MoHRE oversees compliance with UAE labour laws, particularly for timely salary payments.

- It validates the Salary Information File with the Central Bank and issues payment orders to WPS agents to release salaries.

- MoHRE also enforces penalties for non-compliance and protects employee rights by ensuring prompt wage payments.

-

Penalties and Violations in WPS

Non-compliance with WPS regulations can lead to various penalties and violations. Employers who fail to register with the WPS, delay salary payments, or underpay their employees can face serious consequences. MoHRE monitors adherence to WPS requirements and imposes penalties accordingly.

MoHRE has come up with ways to handle any fraudulent acts, and the following is how penalties apply as per Ministerial Resolution No.15 of 2017:

-

- Providing fake data to evade the law incurs a fine of AED 5,000 per worker and AED 50,000 for multiple workers.

- If an employer fails to pay within the due date, each worker will be fined AED 1,000.

- If the employer forces the workers to sign fake salary slips, the fine is AED 5,000 per worker.

Wage Protection System Implementation

The WPS UAE was introduced to ensure all employees receive their salaries in full and on time through a monitored system. Consequently, the system tracks salary payments and alerts authorities if employers do not comply with regulations. The system applies to all private-sector companies registered with MoHRE, including free-zone companies. However, it excludes those registered in the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM).

Moreover, the WPS safeguards workers by ensuring they receive the full salary amount without unauthorised deductions. If employees face delays in receiving payments, they can report these issues. The Central Bank of the UAE also approves banks, exchange houses, and other financial entities to transfer salaries.

How to Register for WPS?

Employers should register via MoHRE’s website. They need a UAE bank account, a contract with a WPS agent, and details on each employee. Before starting the process, they need to prepare the following:

-

- A business account registered with a UAE bank.

- A contract with the WPS agent responsible for salary distribution. This agent could be a WPS agent, a bank, an exchange, a FinTech company, or another financial institution, provided they are registered with MoHRE.

- Details on each employee, including their salary range.

- Payroll information.

-

Documents Required

Preparing accurate Salary Information Files (SIFs) to use the WPS UAE effectively is essential.

Create accurate Salary Information Files in Excel. Enter the employee details record (EDR) for each employee. Make sure to fill in each column with the following details for every individual:

-

- Employee ID

- Employee Name

- Basic Salary

- Allowances

- Deductions

- Total Salary

-

Enrollment Process

The enrollment process for the WPS involves the following steps:

-

- Register with MoHRE

- Open a UAE Central Bank account for payroll processing

- Select a WPS-approved agent

- Generate and submit the SIF file

- Payment to employees

- Compliance monitoring

Salary Distribution Procedure

Salaries are distributed via bank accounts or WPS cards, which are like debit cards with similar functionalities.

-

Methods for Salary Withdrawal

There are two ways to withdraw your salary from WPS UAE.

-

- Through WPS Card

A WPS card is an easy choice for employees without a bank account. WPS-registered companies can use money exchanges in the UAE. It also provides affordable payroll services that comply with WPS regulations.

-

-

Through ATM Machine

-

Employees can use their ATM card to withdraw their wages if a bank account is registered in the UAE. This approach offers a simple way to get money from any ATM.

-

Timeline for Salary Disbursement

AS per Wage Protection System UAE, employers must disburse salaries within 15 days of the due date to avoid penalties. Thus, timely payments are essential for compliance.

-

Payslip Specification

The WPS salary system UAE must include key details to ensure transparency and compliance. These payslip specifications typically include the following:

-

- Employee Information: Name, employee ID, job title.

- Employer Information: Company name, address, and WPS code.

- Salary Breakdown: Basic salary, allowances, deductions, gross, and net pay.

- Payment Date: Date of salary disbursement.

- WPS Reference Details: Unique transaction ID linked to WPS records.

WPS Adherence and Reporting

The WPS UAE requires strict adherence to ensure the timely and accurate payment of employees’ salaries. Here is the breakdown:

-

-

Reporting Obligations

-

Employers must maintain transparent and accurate records of their wage payments as part of their adherence to WPS. Regular reporting ensures compliance and also builds trust within the workforce.

-

-

Audits and Inspections

-

Audits and inspections ensure compliance with the Wage Protection System. The Ministry of Human Resources and Emiratisation regularly audits and inspects employers to ensure compliance with WPS regulations and accurate salary payments.

Issues and Solutions in WPS

Wage Protection System faces technical challenges, delayed salary processing, and compliance difficulties for small businesses. These problems often stem from outdated payroll systems, data submission errors, and insufficient awareness. To address these issues, businesses should invest in advanced payroll software, provide regular training for HR teams, and ensure clear communication with financial institutions.

Typical WPS-Related Challenges

Addressing WPS-related challenges in the UAE requires a proactive approach from employers and regulators. Common issues include technical system errors, delays in salary processing, and data security issues. Let’s have a look at these challenges in detail:

-

-

Salary Delay

-

If you do not submit the WPS UAE file on time, delays can occur, leading to late salary payments. This may result in employer fines or penalties and employee dissatisfaction.

-

-

Technical System Errors

-

The WPS UAE system may experience technical downtime or maintenance, delaying file processing and salary disbursement. You should monitor the system status regularly and plan payroll submissions accordingly. Submitting the payroll well in advance can help mitigate issues caused by unexpected downtime.

-

-

Data Security Issues

-

Managing sensitive employee payroll data involves risks related to data privacy and security. Ensuring that businesses handle data securely while meeting WPS UAE requirements is essential but can be challenging for some.

Tackling WPS-Related Challenges

While the Wage Protection System brings significant benefits, some challenges persist that employers and employees must address effectively. As discussed in the above section, let’s explore employer and employee rights and best practices to tackle these challenges.

-

-

Employer Best Practices

-

Employers should ensure accurate and timely salary transfers via approved channels, maintain up-to-date payroll records, and comply with all regulations to avoid penalties. Additionally, employers should educate themselves about WPS updates, ensure proper documentation, and offer transparency in wage-related matters.

-

-

Employee Rights and Education

-

Workers should know of their rights under the WPS. This includes the guarantee of receiving their agreed-upon salaries on time. It is essential to provide employees with easy access to information about their rights, how the WPS works, and channels to report delays or discrepancies.

Future of Wage Protection System

The WPS UAE is evolving with technologies like blockchain and AI, enhancing transparency and coverage for various worker segments.

-

-

Technological Innovations

-

Technological innovations are transforming WPS UAE. Blockchain is enhancing salary processing for better transparency and security. On the other hand, AI and machine learning now predict non-compliance, analyse payment patterns, and spot irregularities in wage disbursements.

-

-

Broader WPS Coverage

-

Initially focused on ensuring wage protection for workers in formal, large-scale enterprises, WPS UAE coverage extends to more vulnerable segments, such as domestic workers, freelancers, and the gig economy.

WPS Impact on the UAE Employment Market

The Wage Protection System has significantly impacted the UAE employment market by promoting transparency and timely employee payments. WPS UAE enhances labour relations and economic development by reducing wage-related conflicts, which boosts worker security, productivity, and satisfaction. This formalisation of the labour market also makes it more attractive to local and international investors, aligns with global standards, and supports business growth. Moreover, WPS contributes to a more reliable and fair business environment, promoting economic development.

Final Words

WPS UAE is a robust framework designed to ensure timely and accurate payment of employee wages, fostering a fair and transparent working environment. By mandating electronic payments through authorised financial institutions, WPS strengthens employer accountability, safeguards employees’ rights, and protects employers from severe penalties. WPS also contributes to a balanced and compliant labour market in the UAE.

Similar Suggestions For You:

|

Know High Water Bill Causes |

|

|

Explore Ministry of Community Development |

|

|

UAE Ministry of Foreign Affairs |

|

|

About Etihad Water and Electricity (EtihadWE) |

|

|

Know About MoI UAE Smart Services in UAE |

|

|

RERA Forms in Dubai |

Frequently Asked Questions (FAQ’s)

Yes, WPS is required for most UAE companies, except for some free zones and government entities. It helps ensure fair wage payment and is vital for employment regulations.

The UAE's Wage Payment System ensures employees receive their salaries on time. The UAE government implements the WPS and mandates that salaries be transferred through approved banks, financial institutions, and exchange centres regulated by the Central Bank.

You can check your WPS status in the UAE through the MoHRE mobile app or website or by visiting TASHEEL centres. Additionally, you can call the MoHRE helpline or use their SMS service to get details.

The WPS electronic salary transfer system ensures employees are paid on time through registered financial institutions. It mandates companies to process wages electronically and is monitored by the Ministry of Human Resources and Emiratisation (MoHRE). WPS enhances transparency, protects workers’ rights, and ensures compliance with labour laws.

Non-WPS salary refers to wages paid outside the Wage Protection System, typically through unofficial channels like cash or non-registered bank transfers.

WPS wage law mandates timely salary payments via electronic transfers from authorised financial institutions. Companies must comply by registering with WPS and paying within 15 days. Is WPS mandatory in UAE?

What is the Wage Payment System in the UAE?

How can I check my WPS status in UAE?

What is the WPS for salary?

What is a Non-WPS salary?

What is the wage law in the UAE?